AgExpert Accounting – the industry standard for Canadian farms

Enter data. Create income and expense reports. Submit returns. And so much more.

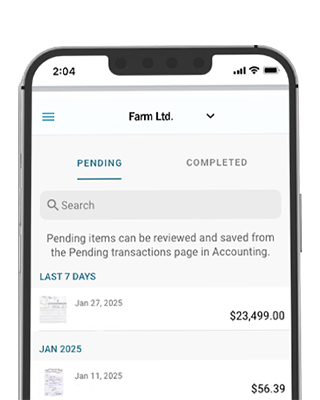

Make record-keeping and accounting easier

Get basic features without spending a dime.

Plans and pricing

To access basic features, set up a free account. From there, you can upgrade to unlock AgExpert Accounting or AgExpert Field Premium. Bundle together for the best farm management experience.

AgExpert Accounting and AgExpert Field Premium for one low price.

What you need to get started.

Everything you need to get the job done.

AgExpert Accounting and AgExpert Field Premium for one low price.

Real people. Real data. Real results.

"I recommend AgExpert to young starting farmers or to existing farmers. It’s another tool you can add to your toolbox to help you discover where you come from and where you’re headed."

– Marilyne Brosseau, Grain farmer

Help when you need it

Tutorials, troubleshooting, training – our AgExpert Customer Care team and online resources are here to help.

Find product supportPrefer to work offline? Explore AgExpert Analyst – our desktop accounting software.

*Only applicable for web-based products (AgExpert Accounting and AgExpert Field).